NV Form D-8 2010-2025 free printable template

Show details

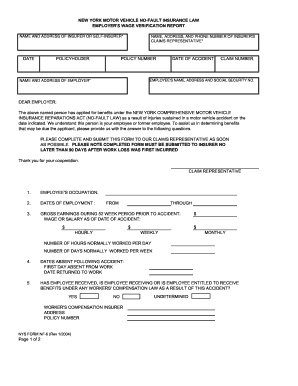

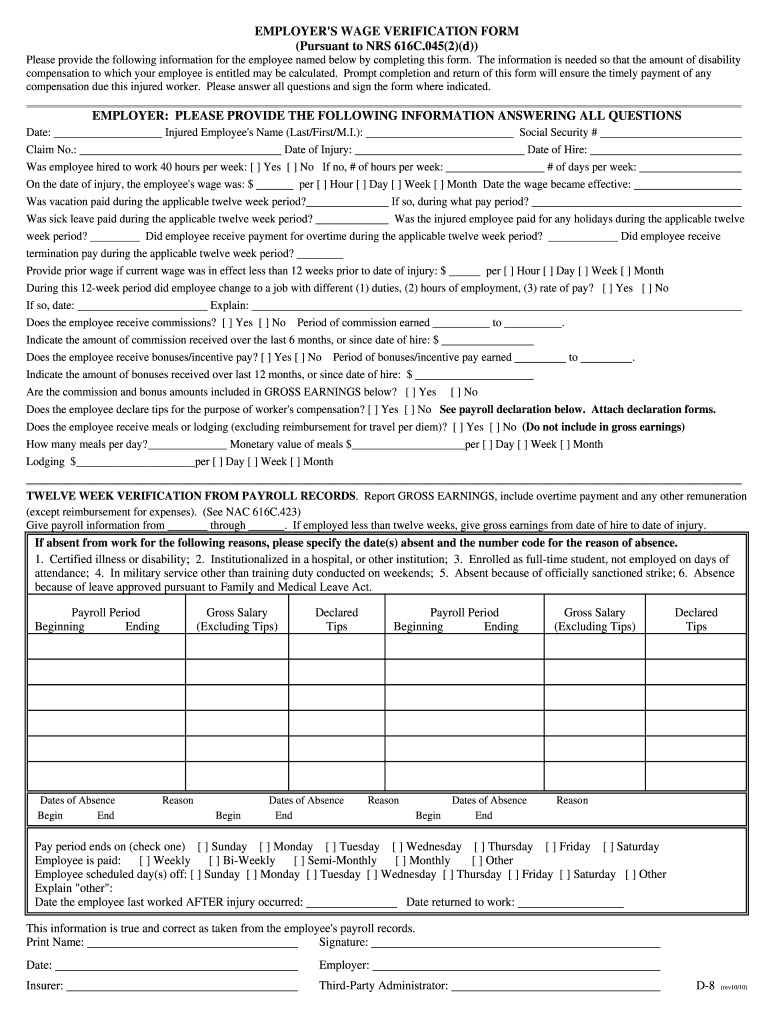

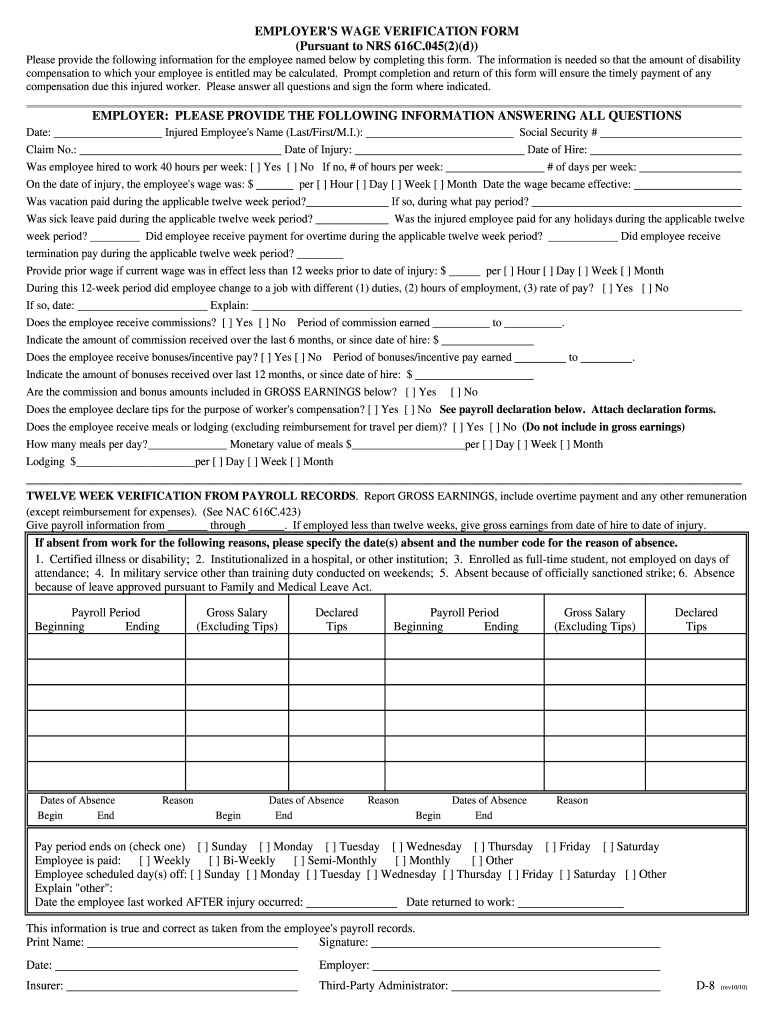

EMPLOYER S WAGE VERIFICATION FORM Pursuant to NRS 616C. 045 2 d Please provide the following information for the employee named below by completing this form. The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated. Prompt completion and return of this form will ensure the timely payment of any compensation due this injured worker. Please answer all questions and sign the form where indicated. EMPLOYER PLEASE PROVIDE THE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign employer wage verification form

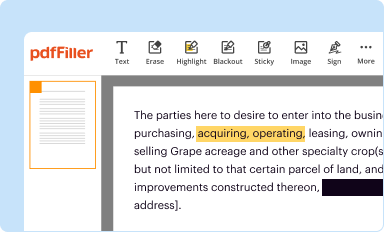

Edit your form d verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

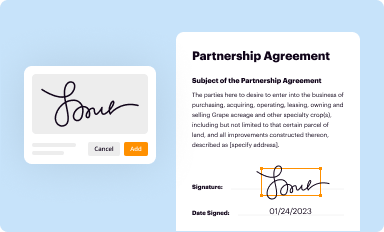

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

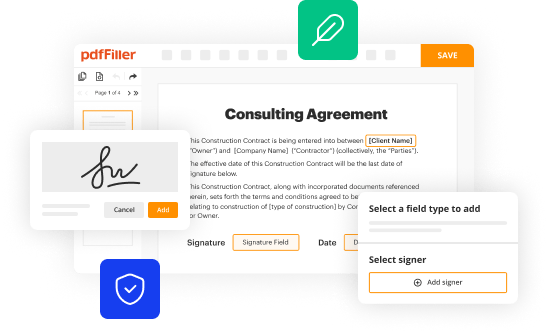

How to edit employee investigation online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form employer wage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to form d 8

How to fill out NV Form D-8

01

Gather all required documents and information needed for the NV Form D-8.

02

Begin by entering your personal information, including your name, address, and contact details in the designated fields.

03

Provide any relevant identification numbers, such as your Social Security Number or Tax Identification Number.

04

Fill out the sections regarding your financial information, including income, expenses, and any applicable deductions.

05

Review the form for accuracy and completeness, ensuring all necessary signatures are included.

06

Submit the form to the appropriate authority or agency as directed.

Who needs NV Form D-8?

01

Individuals or entities required to report certain financial information for tax purposes.

02

Taxpayers in Nevada who need to declare income that falls under specific tax regulations.

03

Businesses operating in Nevada that need to comply with state reporting requirements.

Fill

form d 8

: Try Risk Free

People Also Ask about wage d 8 form

What are the exemptions for workers comp in Nevada?

Nevada Workers' Compensation Exemptions Employment covered by private disability and death benefit plans. Casual employment that lasts no more than 20 days and has a total labor cost under $500 (casual employment means a worker only gets hired for work that's needed)

What is a d6 form in Nevada?

D-6 Injured Employee's Request for Compensation (7/99) D-7 Explanation of Wage Calculation (7/99) D-8 Employer's Wage Verification Form (10/10)

Is workers comp mandatory in Nevada?

Yes. All employers in the state of Nevada are required to have workers' compensation insurance. Nevada law provides for benefit types and calculations to be the same regardless of the type of workers' compensation coverage. What happens to my claims and my benefits if my employer changes insurance companies?

What is the first report of injury form for workers comp in Nevada?

Form C-1 Notice of Injury or Occupational Disease (Incident Report). This form should be filled out immediately after the accident by the employee's supervisor/manager. One copy of the form must be delivered to the injured employee, and one copy of the form must be retained by the employer.

What is the $36000 cap for workers comp in Nevada?

Non-compensation Officers apply a minimum of $500 per month with a maximum of $36,000 per year. FOR CURRENT RATING PAYROLL: Be sure to contact the Nevada Department of Business and Industry to acquire current rating payrolls and instructions on how to properly use them. LLC Members:Treated same as corporation.

How do I file for workers comp in Nevada?

In Nevada, a workers' compensation claim begins when a C-4 form is sent to the insurance company that your employer uses for workers' compensation coverage. You will need to fill out your part of the C-4 form the first time you visit a medical provider for treatment of your work injury.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employers wage verification form nf 6 to be eSigned by others?

Once your form nrs d is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find verification nrs 616c?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific d 8 form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the d8 form in Gmail?

Create your eSignature using pdfFiller and then eSign your wage form d immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is NV Form D-8?

NV Form D-8 is a document used in Nevada for reporting certain financial transactions or operations conducted by businesses operating within the state.

Who is required to file NV Form D-8?

Businesses that meet specific criteria, such as those engaging in certain types of financial activities or transactions, are required to file NV Form D-8.

How to fill out NV Form D-8?

To fill out NV Form D-8, businesses must provide relevant information as specified in the form, ensuring all sections are completed accurately before submission.

What is the purpose of NV Form D-8?

The purpose of NV Form D-8 is to ensure compliance with state regulations regarding financial reporting, and to provide transparency about business activities.

What information must be reported on NV Form D-8?

NV Form D-8 requires reporting of various financial details, including transaction types, amounts, and any other pertinent information as outlined in the form instructions.

Fill out your NV Form D-8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 616c is not the form you're looking for?Search for another form here.

Keywords relevant to employer wage verification letter

Related to employer verification d

If you believe that this page should be taken down, please follow our DMCA take down process

here

.